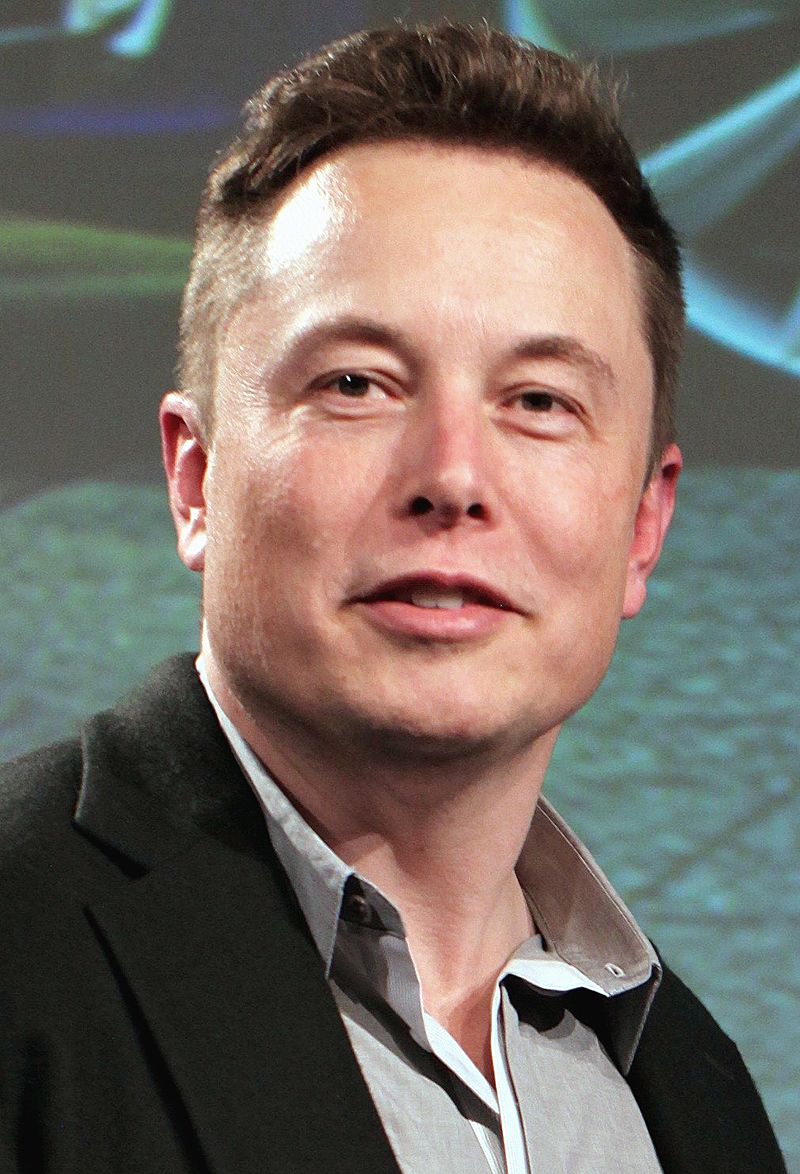

Elon Musk Claims ESG Is A “Scam” and A Way to Avoid Forever Chemicals, Citing Climate Change and Y2K As Examples

What Is ESG & Is It A Scam?

Environmental, social, and corporate governance is an approach to evaluating the degree to which a corporation works on behalf of social goals that extend beyond the role of a corporation to maximize profits on behalf of the shareholders of the corporation.

This goes beyond the traditional role of a corporation to maximize profits on behalf of the shareholders of the corporation. ESG criteria are a set of guidelines for the behavior of a firm that are used by investors that are socially conscious of screening possible investments. Environmental criteria evaluate a firm based on the measures it takes to protect the environment, taking into account, for instance, the policies it has in place to deal with climate change.

The company’s management of its relationships with its employees, suppliers, customers, and the communities in which it operates is evaluated according to social standards. The leadership of a firm, the compensation of its executives, audits, internal controls, and the rights of its shareholders are all aspects of governance.

The Recent Controversial Comments Made by Elon Musk

The majority of the criticism is directed at the three words that are represented by the acronym “ESG,” which are “environmental, social, and governance.”

ESG is used in conjunction with standard financial analysis in order to take into consideration “externalities” that were previously neglected. Some examples of these are carbon emissions, diversity in boardrooms, and employee satisfaction. Regrettably, environmental, social, and governance (ESG) investing is sometimes incorrectly referred to as a “woke” style of investing that introduces a “socialist agenda” into financial markets.

It seems that more and more people in authoritative positions are behind these foolish attacks. Elon Musk recently tweeted that “ESG is a scam” after Tesla was removed from a major ESG index for a lack of disclosure around key environmental and social issues and allegations of racism on the factory floor.

The reasons for Tesla’s removal included a lack of disclosure around key environmental and social issues and allegations of racism on the factory floor. Peter Thiel, a prominent venture entrepreneur and the creator of PayPal, gave a speech in April in which he referred to ESG as “a hate factory” and linked the organization to the Chinese Communist Party.

Even Mike Pence, who had previously held the position of vice president of the United States, joined in on the criticism, claiming that “liberal activist investors are forcing private companies to adhere to ESG investing principles, elevating left-wing environmental, social, and corporate governance goals over the interests of the business.”

The majority of these attempts appear to be designed to gain political favor with a certain group of people. These remarks made by Musk are consistent with Musk’s more recent support of right-wing ideology. Thiel delivered his remarks at a Bitcoin conference, where attendees, who must have been unhappy about the criticism that cryptocurrencies are receiving for their huge carbon footprint, were likely listening.

Pence was delivering his remarks at an oil and gas conference in which investors seeking to decarbonize their portfolios were grilling company leaders with difficult questions. It should not come as a surprise to us that investors in unsustainable assets are feeling the heat and that they would fight back with indignation against a movement that makes them accountable for the pollution they are causing.

However, not all of the criticisms are political in nature and use broad strokes. Insiders in this industry are providing me with more sophisticated criticisms. In a recent TEDx address, Tariq Fancy, a former chief investment officer for sustainable investing at BlackRock, referred to divestment from fossil fuels as a placebo and compared it to the practice of providing wheatgrass juice to a cancer patient.

After disregarding the threat posed by climate change during a presentation at a conference and telling us what he truly thinks, Stuart Kirk was removed from his position as head of responsible investing at HSBC. He said, “Who cares if Miami is six meters submerged in 100 years?” For a very long time, Amsterdam was submerged to a depth of six meters (or twenty feet), and that was a very pleasant area.

It is not surprising that these remarks have produced quite a commotion. They demonstrate that many huge financial firms are only giving sustainable investment lip service, and we shouldn’t mislead ourselves into thinking that they are in it to transform the world. They are just paying lip service to sustainable investing. Since maximizing profits is still the end goal, sustainable investors need to be aware of the possibility of greenwashing and perform adequate research before investing.

These comments also demonstrate that there is a significant lack of skilled workers in the industry of sustainable investing. It is clear that Fancy and Kirk do not have any prior training in environmental studies, systems thinking, or sustainable practices because of this. If we think that a worldview that prioritizes business can assist us in resolving issues related to sustainability, we are deceiving ourselves. Although Fancy and Kirk have done an excellent job pointing out issues in the responsible investment business, they do not provide much in the way of potential remedies.

DO YOU NEED EXPERT ADVICE?

We have encountered victims who were mentally and emotionally drained when they were scammed out of their money. We can help you with your legal and technical concerns. We can help you get your money back.

Are These Criticisms Sufficient Reasons To Disregard All Companies & Funds That Engage in Ethical Investment?

Of course not. If anything, the political attacks are evidence that we are moving in the right direction because they demonstrate that we have their attention.

The more sophisticated criticisms present us in the responsible business with an opportunity to pick up our game and fight back against those who are criticizing us. We require improved communication and clarification of the nature of ESG as well as what it is not. In order to substantiate our assertions, we require extensive academic study.

It is necessary for us to take the initiative in terms of disclosure and transparency, pulling back the curtain for anyone who is interested. And we need people who already change agents and social innovators to get educated in finance so that our huge financial institutions are staffed with people who have the correct perspective in positions of power.

Chargeback Way makes use of current principles, buyer privileges, and innovative solutions to ensure that you receive the best possible recovery assistance. Stay updated for more news and alerts.

Sources

Find Related News

Subscribe to Our Newsletter

Scam Recovery Resources

Dating Scams on A Rise: Anne Lost $98,000 & We Helped Her Get it Back!

Online dating sites and apps are used by millions of individuals worldwide. There are also several success tales of people finding love and companionship over the internet. However, in addition to the achievements, there are also online dating frauds, which are on the rise.

A $1 Billion Spike in Dating Scams is Crippling The Economy – Find Out All About Romance Scams

Online dating scams have been getting more and more popular over the past five years. Since 2013, 10% of all reported fraud cases have been due to online dating scams. The number only continues to increase as internet companies grow, so it is important that we are aware of what they are and how they work.

Scoular Co. Email Scam Case- How The Firm Got Swindled Out Of $17.2 Million

The emails appeared to come from Scoular Chief Executive Officer Chuck Elsea and the company’s auditing firm in Omaha, Nebraska. The fraud, which occurred in June, was investigated by the Federal Bureau of Investigation.

What Can Scammers Do With Your Paypal Email?

Change all of your passwords right away, remove any malicious software you may have downloaded, and, if necessary, contact your credit card company if you think you’ve been scammed. To report the scam and receive assistance with the next steps, get in touch with your neighborhood law enforcement agency.

Warning!!! 10Brokers.com Blacklisted for Investment Scams

10Broker is also not an Fx dealer with a license. The corporation will breach the rules, putting its shareholders at risk in the meantime. The system will not last much longer in the marketplace, and it is predicted that it will be shut down once it has stopped defrauding consumers.

Our news section focuses on reporting scam related news and alerts. We aggregate information from the web, as well as, reach out to our contacts so that we can get the latest scoop on scam operations.

FundTrace is committed to upholding the journalistic standards online, including accuracy. With our news reporting, our policy is to review each issue on a case by case basis, immediately upon becoming aware of a potential error or need for clarification, and to resolve it as quickly as possible.

We Can Help You

Victims of scams are stressed out because they don’t know what to do. We have the tools and experience to fight off scams, and our team can help you in getting your money back.

Please fill up the form now so that our team will get in touch with you.