St. Louis Man Sentenced To 2 Years in Prison for COVID-Related Fraud

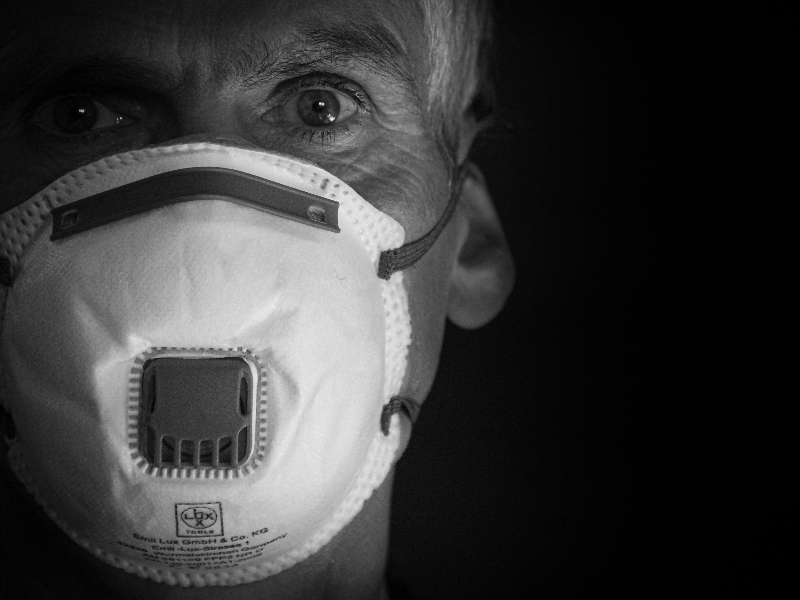

In 2020, Prince Vamboi used an N-95 mask to defraud a Wisconsin corporation out of $159,000. He also admitted to further deceptions.

After earning more than $200,000 through frauds, including an N-95 mask scam, a St. Louis man was sentenced to two years in prison. Prince Vamboi, 40, was sentenced to two years in prison on Tuesday after pleading guilty in February to three felony counts of wire fraud conspiracy and one count of bank fraud.

Vamboi defrauded a Wisconsin corporation out of $159,000 in an N-95 scam in 2020, according to a news statement from the Department of Justice. Vamboi’s co-conspirator ordered Verona Safety Supply to send the money to one of Vamboi’s bank accounts for the masks, but the company never got them. Vamboni acquired a $18,750 Paycheck Protection Program loan unlawfully the next year. He also deposited money he unlawfully received from the state of Washington for unemployment insurance.

Vamboni also acknowledged changing a $35,098 check by replacing the name of a Texas company with his own and depositing it in a bank account he controlled. The US Postal Inspection Service looked into the matter. Diane is an Assistant United States Attorney who attended to the matter. The United States Postal Inspection Service and its law enforcement partners will aggressively investigate those who deal in checks stolen from the U.S. Mail as part of their fraud schemes,” Inspector in Charge William Hedrick said in a press release.

Hedrick is the head of the Inspection Service’s Chicago Division, which includes the St. Louis Field Office. In December, the U.S. The Secret Service said nearly $100 billion at minimum has been stolen from COVID-19 relief programs set up to help businesses and people who lost their jobs due to the pandemic.

The estimate was based on Secret Service cases and data from the Labor Department and the Small Business Administration, said Roy Dotson, the agency’s national pandemic fraud recovery coordinator, in an interview. The Secret Service didn’t include COVID-19 fraud cases prosecuted by the Justice Department. While the fraud accounts for roughly 3% of the $3.4 trillion dispersed, the amount stolen from pandemic benefits programs shows “the sheer size of the pot is enticing to the criminals,” Dotson said.

More on Corona Virus Scams

Three persons have previously pleaded guilty to participation in COVID-19 relief fraud schemes.

According to David H. Estes, U.S. Attorney for the Southern District of Georgia, the defendants were all charged via information as a result of ongoing investigations into the misuse of the US government’s COVID-19 financial relief programs. Following their guilty pleas, the defendants face up to 30 years in prison, as well as significant reparations and fines, followed by a term of supervised release. In the federal system, there is no such thing as parole.

U.S. Attorney Estes stated, “Congress approved significant cash to assist small businesses during the early shutdowns and financial problems of the COVID-19 outbreak.” “We will identify and hold accountable anyone who exploits these funds to fulfill their own greed at the expense of taxpayers, working with our law enforcement partners.”

In March 2020, the Coronavirus Aid, Relief, and Economic Security (CARES) Act was signed into law. The Small Business Administration (SBA) was allowed by the CARES Act to give and/or guarantee loans to keep small businesses afloat during the pandemic’s financial hardships. Three individuals agreed to profiting from these programs, while a fourth is awaiting additional legal proceedings. In order to get Economic Injury Disaster Loans (EIDL) and/or Paycheck Protection Program (PPP) loans, all of the defendants admitted or were accused of making false and fraudulent representations about their enterprises, real or imaginary.

DO YOU NEED EXPERT ADVICE?

We have encountered victims who were mentally and emotionally drained when they were scammed out of their money. We can help you with your legal and technical concerns. We can help you get your money back.

Among the defendants are the following

After pleading guilty to Conspiracy to Commit an Offense Against the United States Government, Shakeena Hamilton, 34, of McRae, Ga., is awaiting sentencing.

Hamilton admitted to assisting others in illegally applying for PPP relief in pleading guilty to the COVID-19 fraud charge, with her activities resulting in the government disbursing more than $2.3 million to banks for other conspirators. The scam netted Hamilton more than $300,000 in kickbacks from the co-conspirators in exchange for her help.

After pleading guilty to Wire Fraud, Anissa Carr, 22, of Hinesville, Ga., and her husband, Montrez Burns, 24, also of Hinesville, are awaiting sentencing. Each defendant acknowledged obtaining tens of thousands of dollars in PPP funding for bogus enterprises through deception.

Anatoly Rybin, 41, of Richmond Hill, Ga., was charged with False Statement on a Loan Application through Information in connection with an application to the SBA for an EIDL loan for which he got $110,300. He is awaiting the outcome of his case in court. Only charges are contained in criminal information; defendants are presumed innocent until and unless found guilty.

SBA OIG Special Agent in Charge Amaleka McCall-Brathwaite remarked, “The Office of Inspector General stands behind the nation’s small businesses by securing and preserving SBA programs that support and uplift them through difficult times.” “The Office of Inspector General remains committed to rooting out corrupt actors and safeguarding the integrity of SBA programs.” I’d like to express my gratitude to the US Department of Justice and our law enforcement partners for their commitment to justice.”

What Can You Do in A Situation Such as This?

You can contact Chargeback Way that makes use of current principles, buyer privileges, and innovative solutions to ensure that you receive the best possible recovery assistance.

You will receive instructions and recommendations to begin your recovery process after proving that your solicitation is valid and that a scam has been submitted. Insight experts, financial experts, and former law enforcement officials make up our colleagues and team of professionals. They’ ll decide on the best plan for recovering your missing valuables together.

They just have one mission: to assist you in recovering your stolen funds in the most efficient and secure manner possible. They will go to every length to retrieve your stolen assets, no matter how big or small the sum is. Contact their anti-fraud specialists right away to begin developing your case and reclaiming the money you were defrauded of!

Chargeback Way will guide you to the entire process when it comes to different kind of scam. Visit our news page for more guidelines and news updates.

Sources

- Author: Associated Press https://www.usnews.com/news/best-states/missouri/articles/2022-04-12/st-louis-man-sentenced-in-coronavirus-aid-fraud-scheme

- Author: Trinity Audio https://www.stltoday.com/news/local/crime-and-courts/st-louis-county-man-sentenced-to-prison-for-lying-to-get-2-7m-in-covid/article_efd783dd-bdf1-504f-b5d4-1cdb9eeed206.html

Find Related News

Subscribe to Our Newsletter

Scam Recovery Resources

47 Year Old Man Almost Lost His Entire Life Savings ($56,000) To A Fake Investment Opportunity Online

Beware of such happenings and never let out your personal information to any website, unknown call, messages, etc. Always have hope and make efforts to recover your stolen funds at any cost.

Explore All The Details Regarding Money Scams to Protect Your Funds From The Tactics of This Malicious Activity

Online money scams are various fraud approaches worked with by cybercriminals on the Internet. Scams can occur in a horde of ways: phishing messages, online entertainment, SMS messages on your cell phone, counterfeit technical support calls, and scareware.

Coincheck – The Most Elaborate Cryptocurrency Scam in History Resulting in A $530 Million Loss

The company had to go through a lot during this challenging time, like halting its operations and modifying its entire customer-facing application portfolio. Also, to avoid such storms striking ever again in the future, they had to develop strategies that could help save the machine data.

A $1 Billion Spike in Dating Scams is Crippling The Economy – Find Out All About Romance Scams

Online dating scams have been getting more and more popular over the past five years. Since 2013, 10% of all reported fraud cases have been due to online dating scams. The number only continues to increase as internet companies grow, so it is important that we are aware of what they are and how they work.

A Man, Some Dogs & A $17,000 Payment Scam Recovery!

The first thing Ayra said to us as soon as she came to our office was, ‘This pet scam was the worst thing that could happen to me at the worst time of my life.’ This broke our team, and thus was the moment we decided to put our utmost energy, expertise, and time into the case, which is what we are best at!

Our news section focuses on reporting scam related news and alerts. We aggregate information from the web, as well as, reach out to our contacts so that we can get the latest scoop on scam operations.

FundTrace is committed to upholding the journalistic standards online, including accuracy. With our news reporting, our policy is to review each issue on a case by case basis, immediately upon becoming aware of a potential error or need for clarification, and to resolve it as quickly as possible.

We Can Help You

Victims of scams are stressed out because they don’t know what to do. We have the tools and experience to fight off scams, and our team can help you in getting your money back.

Please fill up the form now so that our team will get in touch with you.